Enhancing Policy Insights: Machine Learning-Based Forecasting

of Euro Area Inflation HICP and Subcomponents

László Vancsura – Tibor Tatay – Tibor Bareith

Forecasting 2025, 7 (4), 63; – Published: 26 October 2025

Abstract

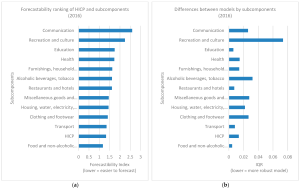

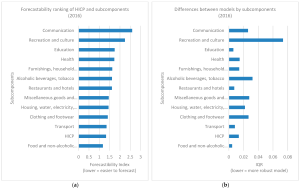

Accurate inflation forecasting is of central importance for monetary authorities, governments, and businesses, as it shapes economic decisions and policy responses. While most studies focus on headline inflation, this paper analyses the Harmonised Index of Consumer Prices (HICP) and its 12 subcomponents in the euro area over the period 2000–2023, covering episodes of financial crisis, economic stability, and recent inflationary shocks. We apply a broad set of machine learning and deep learning models, systematically optimized through grid search, and evaluate their performance using the Normalized Mean Absolute Error (NMAE). To complement traditional accuracy measures, we introduce the Forecastability Index (FI) and the Interquartile Range (IQR), which jointly capture both the difficulty and robustness of forecasts.  Our results show that RNN and LSTM architectures consistently outperform traditional approaches such as SVR and RFR, particularly in volatile environments. Subcomponents such as Health and Education proved easier to forecast, while Recreation and culture and Restaurants and hotels were among the most challenging. The findings demonstrate that macroeconomic stability enhances forecasting accuracy, whereas crises amplify errors and inter-model dispersion. By highlighting the heterogeneous predictability of inflation subcomponents, this study provides novel insights with strong policy relevance, showing which categories can be forecast with greater confidence and where uncertainty requires more cautious intervention.

Our results show that RNN and LSTM architectures consistently outperform traditional approaches such as SVR and RFR, particularly in volatile environments. Subcomponents such as Health and Education proved easier to forecast, while Recreation and culture and Restaurants and hotels were among the most challenging. The findings demonstrate that macroeconomic stability enhances forecasting accuracy, whereas crises amplify errors and inter-model dispersion. By highlighting the heterogeneous predictability of inflation subcomponents, this study provides novel insights with strong policy relevance, showing which categories can be forecast with greater confidence and where uncertainty requires more cautious intervention.

Our results show that RNN and LSTM architectures consistently outperform traditional approaches such as SVR and RFR, particularly in volatile environments. Subcomponents such as Health and Education proved easier to forecast, while Recreation and culture and Restaurants and hotels were among the most challenging. The findings demonstrate that macroeconomic stability enhances forecasting accuracy, whereas crises amplify errors and inter-model dispersion. By highlighting the heterogeneous predictability of inflation subcomponents, this study provides novel insights with strong policy relevance, showing which categories can be forecast with greater confidence and where uncertainty requires more cautious intervention.

Our results show that RNN and LSTM architectures consistently outperform traditional approaches such as SVR and RFR, particularly in volatile environments. Subcomponents such as Health and Education proved easier to forecast, while Recreation and culture and Restaurants and hotels were among the most challenging. The findings demonstrate that macroeconomic stability enhances forecasting accuracy, whereas crises amplify errors and inter-model dispersion. By highlighting the heterogeneous predictability of inflation subcomponents, this study provides novel insights with strong policy relevance, showing which categories can be forecast with greater confidence and where uncertainty requires more cautious intervention.Keywords: HICP and subcomponents; Euro area; inflation forecasting; machine learning; economic crises